Funding Your College Degree Through Real Estate Flipping: Tips for Adult Students

Many adult students face the challenge of finding ways to finance their

college education while balancing other responsibilities. One potential

solution is real estate flipping, a strategy that can generate income while

providing valuable financial management experience.

Is It Easier To Find a Home To Buy Now? Amongst the best …

Is It Easier To Find a Home To Buy Now? Among the very best concerns purchasers have in reality dealt with over the previous variety of years has really in reality been a lack of homes marketed. At the really very exact same time, the chart above likewise exposes there are still significantly less homes…

The Latest on the Luxury Home Market And if you’re in the ma…

The Latest on the Luxury Home Market And if you’re in the market for a million-dollar home, now is an excellent time to check out the growing high-end market. The top of the market, or luxury homes, can mean various things depending on where you live. With more million-dollar homes on the market and costs…

Ways You Can Work With Other Real Estate Investors

Real estate investing isn’t a one-person show. Check out these ways you can

work with other real estate investors to connect and maximize profits.

Lower Mortgage Rates Boost Your Buying Power

Mortgage rates are trending down and that’s great news for your bottom

line. As rates drop, your monthly payment on your next home does too. Even

a small change in mortgage rates can have a big impact on your purchasing

power. If you put your search on hold when mortgage rates were higher,

think about how much you could save now that rates are coming down

How to Market Your Property to Snowbirds

Every year like clockwork, thousands of people flock down south to enjoy the warmer weather and get away from the cold. Affectionately dubbed “snowbirds,” they’re mostly retirees that come from the northern parts of the U.S. This seasonal migration is driven by the simple desire for the sunnier skies and warmer temperatures of Florida. If you’re ready to direct these seasonal travelers to your doorstep, the key is understanding how to market it effectively. When done appropriately, you can catch the eye of these winter wanderers and ultimately book it up for the season. Preparing Your Vacation Rental ProperlyBy 2028, online sales will account for 76% of the vacation rental market. With more snowbirds journeying southward, they’re seeking more than a change in latitude — they want a home away from home. After traveling great distances, the warm embrace of a thoughtfully prepared vacation rental can make all the difference in their winter retreat. It’s essential to ensure your space exceeds their expectations, making their stay comfortable, convenient and memorable.To connect with snowbirds, consider your rental from their perspective. What amenities would transform a nice stay into an exceptional one? Think beyond the basics. From high-speed internet and smart TVs to a fully equipped kitchen and comfortable outdoor spaces to enjoy the Florida sun are just the start. Additionally, consider accessibility features that cater to retirees, ensuring your property is welcoming to all. To guarantee your rental is stocked with top-of-the-line amenities, consider creating a checklist that includes the following:High-speed Wi-FiSmart TVs with cable or streaming service accessStocked kitchen with basic cooking ingredientsComfortable, high-quality beddingAccessible bathroom featuresOutdoor seating areaLocal guides and mapsContact list for local services, such as health care and grocery delivery1. Highlight the Right FeaturesWhen marketing your property to snowbirds, the right thing to do is to show off the property’s features that matter most. Remember, these winter visitors are looking for more than a place to stay — they seek comfort and joy in a seasonal home. Focus on showcasing aspects of your property that enhance their winter escape, such as its proximity to local attractions, beaches or golf courses. Also, remember to emphasize convenience and comfort through aspects such as:A well-maintained gardenA cozy patioA view that captures the essence of Florida’s beautyWhen you highlight these features in your marketing materials, you’ll be sure to grab their attention while helping them picture your property as the perfect winter retreat.2. Optimize Your Listing for Online PlatformsOptimizing your listing is crucial in attracting snowbirds to your property. An online listing is typically the first touchpoint with renters, as they’re most likely to use search to find a vacation home. To ensure potential guests see your listing, use keywords in the title and its description. The title should describe your rental and compel them to click for more.The description should also detail a thorough explanation of your property. It must include details that emphasize features that appeal to snowbirds, including the layout, accessibility and comforts. The purpose of the description is to make your property sound ideal enough for a lengthy stay. Yet, it should do more than describe the features — it must help the traveler envision themselves in the home. For instance, you could convey the patio as the perfect way to enjoy the sunrise and a morning coffee. Then, you should always include a call-to-action that shows the potential guest what to do next, so ensure you have a “Book Now” button.3. Leverage Social Media MarketingAnother way to attract snowbirds to your property is with the use of social media. Platforms like Facebook, Instagram and Pinterest can showcase it with captivating photos and videos. Each post should highlight the amenities that are most attractive and appealing to snowbirds.It also helps to use engaging stories that weave a narrative around local attractions and the tranquility awaiting them. Through the use of stories, you can coax potential renters and ensure your property stands out among a sea of other choices.Targeted ads are also beneficial for increasing your reach. You can use settings to target your audience based on filters like age, interests, location and more. With the clever use of targeted advertising, you can make the most of your ad budget and attract snowbirds to your winter haven.4. Start a Vacation Rental BlogA vacation rental blog is a smart way to captivate snowbirds. By sharing insights about local life, you give potential renters a taste of what living in your property could be like. When you incorporate stories and expertise into your blog posts, snowbirds will appreciate the helpful tips you provide. You can make it sound like a destination to experience, enhancing your property’s appeal. Offering value beyond the walls of your rental establishes you as a knowledgeable host passionate about giving guests an unforgettable stay. Plus, a blog can boost your property’s visibility and attract a dedicated following of snowbirds looking for the perfect place.5. Offer Flexible Rental TermsSnowbirds have needs that often differ from typical short-term rentals. Many of them seek longer stays to escape the winter months, making traditional one-week or one-month rental periods less appealing.Consider adjusting your vacation rental strategy to accommodate three- to six-month stays, which is what the snowbird demographic mostly prefers. Offering extended stays can make your property more appealing to snowbirds and increase their likelihood of booking through you. Additionally, consider implementing adjustable pricing models or special rates for extended stays. With these enticing offers, you can encourage longer bookings and ensure a steady occupancy rate throughout the season.6. Provide Unique OffersConsider offering unique incentives to make your property even more attractive. For instance, you could craft membership packages that offer discounts on local attractions like restaurants or golf courses. This strategy works for catering to a snowbird’s social lifestyle they want to experience within their community.An easy way to secure these deals is by partnering with local businesses. These relationships will be crucial in appealing to snowbirds looking for an immersive and cost-effective winter escape. Plus, it’ll make you seem like a thoughtful and connected host, positioning your property for increased potential.Attracting Snowbirds to Your PropertyMarketing your property to snowbirds takes several strategies to make it appealing. Yet, remember the importance of personal touch. Once you truly understand what your target audience wants in a vacation rental property, you can make your guests feel welcome. Whether it’s through personalized welcome baskets or personally created local guidebooks, small gestures make a big impact. Think of it as more than a transaction but creating a memorable experience instead. Doing so will keep snowbirds returning year after year.

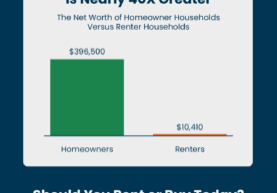

Ways Your Home Equity Can Help You Reach Your Goals , there’…

Ways Your Home Equity Can Help You Reach Your Goals , there’s something you’re going to wish to comprehend more about– and that’s home equity. And, if you’re not prepared to move just yet, you can use the equity you have to enhance your present home. Let’s link if you desire to comprehend how much…

Now’s a Great Time To Sell Your House And because there stil…

Now’s a Great Time To Sell Your House And because there still aren’t sufficient homes for sale to satisfy that need, sellers see some serious advantages. More sellers are coming to recognize conditions are ripe for a relocation. If you note throughout the spring and early summer, you may sell your house rapidly and for…

The Down Payment Assistance You Didn’t Know About For first-…

The Down Payment Assistance You Didn’t Know About For first-time purchasers, the name of the video game with down payments is making sure you’re taking advantage of all the resources out there created to help you. Just because the average down payment is rising doesn’t indicate down payment requirements are going up. It’s really just…

Relocating the Heat: 6 Tips for Staying Cool This Summer

Throughout the summertime, moving can be challenging, especially when the temperatures skyrocket. For that reason, moving in the heat requires additional preparation and care to ensure you stay safe and cool. Whether relocating across town or moving to a new state, managing the heat is vital for a smooth relocation. With this in mind, we’ll…